bradford tax institute 199a calculator

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. For aggregration of businesses see Caution.

Today S Cpa Jul Aug 2019 By Ambizmedia Issuu

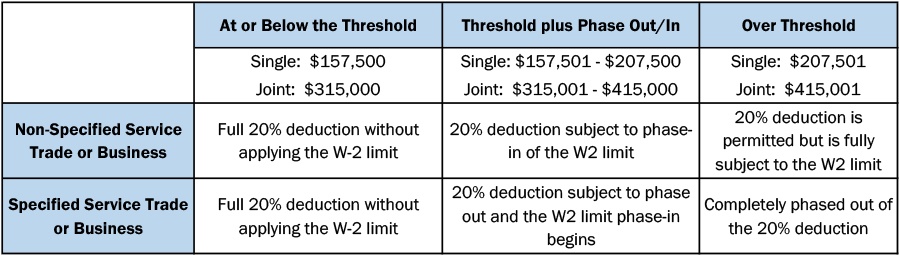

199A Calculator Is Business-by-Business without Aggregation.

. Httpsbitly 2PRruWp With our 199A calculator you can quickly see how you win or lose based on your qualified. Help your customers answer their personal financial questions from your website. Discover Helpful Information And Resources On Taxes From AARP.

Read customer reviews best sellers. See more of Bradford Tax Institute on Facebook. Section 199A tax-reform calculator.

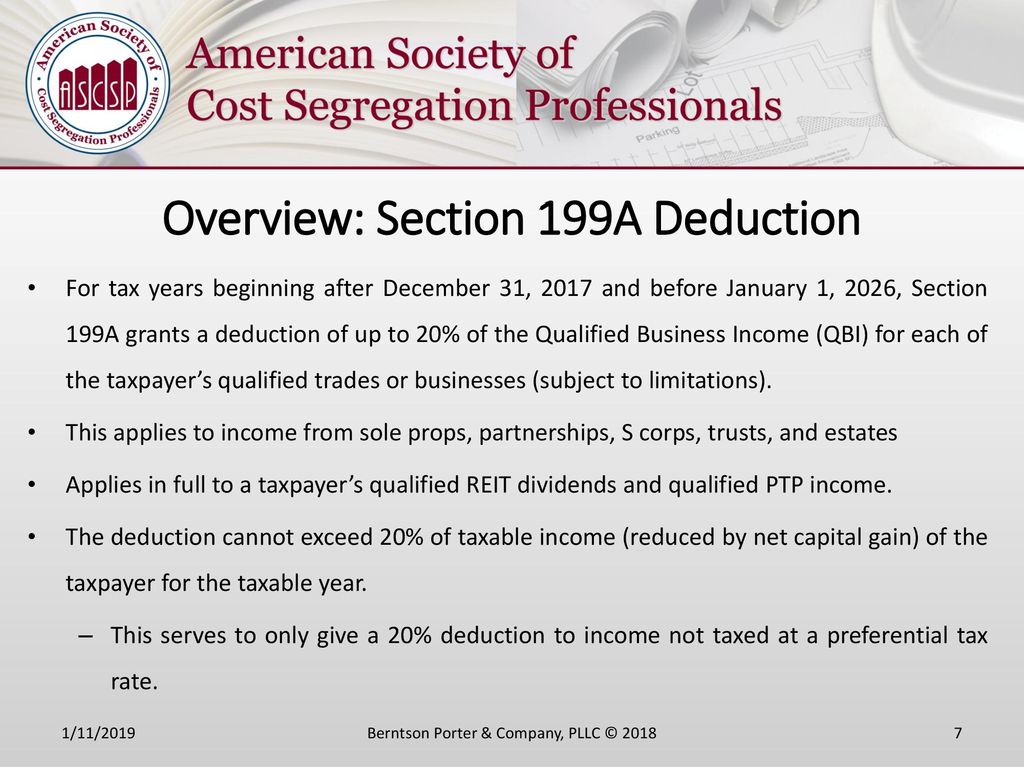

But the mechanics of making the. Wages Paid by Business. Take the pain out of manually computing Section 199A benefits by using our free Section 199A tax-reform calculator.

Check out the Bradford Tax Institute 199A calculator now. Ad Browse discover thousands of unique brands. If you qualify the new Tax Code Section 199A offers a 20 deduction on your qualified business income.

Ad No Money To Pay IRS Back Tax. Create an interactive experience. Ad Enhance your Website with TCalc Financial Calculators.

Home Office Depreciation Wcg Cpas

New Editions Print Digital Solutions Lexisnexis

W Murray Bradford Taxreductioncpa Twitter

Deducting Meals And Entertainment In 2021 2022

The Tax Cuts And Jobs Act How It Still Affects You Medical Association Of The State Of Alabama

Section 199a Made Easy Youtube

Icymi The Tax Cuts And Jobs Act Qbi Deduction Issues For Professionals The Cpa Journal

Qualified Business Income Deduction For Dummies Youtube

Section 199a And Your Anesthesia Practice Dpi Anesthesia

20 Qbi Deduction Calculator For 2021

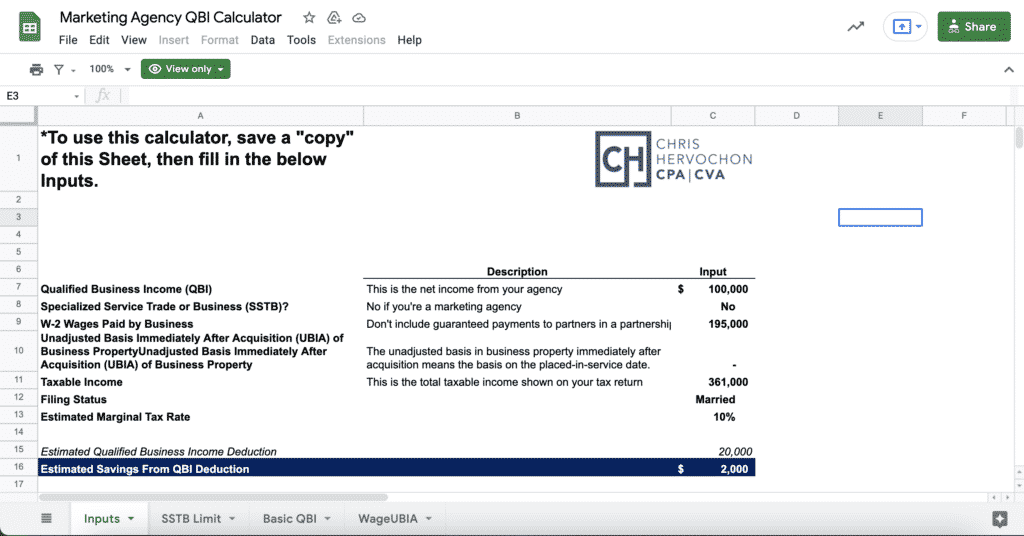

Marketing Agencies And The Qbi Deduction Chris Hervochon Cpa

The Accidental Cfo The Section 199a Deduction By Chris And Trish Meyer Provideo Coalition

Icymi Proposed Regulations Clarify The Irc Section 199a Deduction The Cpa Journal

W Murray Bradford Taxreductioncpa Twitter

New Editions Print Digital Solutions Lexisnexis

How College 529 Savings Account Withdrawals Are Taxed Why You May Not Want To Use A 529 Plan Altogether